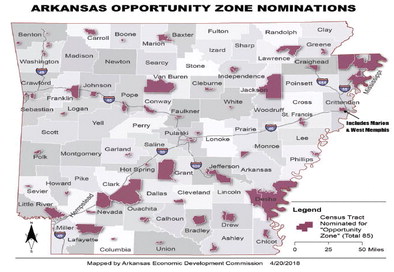

Marion, West Memphis among state nominees for ‘Opportunity Zones’

Marion, West Memphis among state nominees for ‘Opportunity Zones’

Treasury Department to spend $ 6.1 trillion on attracting business to commu-nities in need

news@theeveningtimes.com

Elected officials buzzed over the news from Governor Asa Hutchinson on Monday. The governor nominated two Crittenden County sites for a U.S.

Treasury program aimed at attracting new business development.

The Governor listed two local sites as part of the 85 he nominated for federal consideration for qualified Opportunity Funds for investing in the new Opportunity Zones. The Treasury Department will make final approval and certify 8,700 zones nationwide as part of the program carrying estimated potential capital for reinvestment of $6.1 trillion.

One site in Marion and one West Memphis vie for a piece of the economic stimulus targeting low- and moderate-income communities across the country.

“I’m excited about the potential investment that will be encouraged in low economic areas of our state,” said Hutchinson. “One of my goals as governor from day one has been to increase economic opportunities for all Arkansans. By Investing in these high-potential areas, we will be able to breathe new life into communities and ensure our state remains economically diverse and healthy.”

U. S. Census tracts provided the basis for determining eligible zones. State governors were able to nominate one-fourth of the eligible areas for Treasury department consideration. Benefits for investors included a temporary tax deferral for capital gains.

State Senator Keith Ingram described the step-up basis for capital gains tax incentive.

“This encourages new business development,” said Ingram. “If you open an new business in an opportunity zone then after five years, if you sell that business, there’s a 50 percent reduction on capital gains tax; and if you hold the business for ten years and sell it, there is a 100 percent tax abatement for capital gains. It’s another economic incentive tool we have.”

Ingram said the nominations bode well for the area. “It mean a lot that the governor and the AEDC chose two sites in Crittenden County,” said Ingram. “It speaks volumes that we have the potential to attract industry into our area that we received two of the 85 nominations in Arkansas.

Ingram watched the development of the federal legislation and indicated Marion and West Memphis were ideal locations.

“This was tailor-made to attract development into the delta.” said Ingram. “This capital gains abatement is a great idea from South Caroline Senator Jim Scott. It’s going to be a major tool in our chest to attract development to the delta.”

Congress established Opportunity Zones under the Tax Cuts and Jobs Act of 2017. The program design drives investment into small business. All tangible property of the qualified business must be within the opportunity zone. Normal sin businesses were excluded. Arkansas Economic Development Commission Executive Director Mike Preston expressed commitment.

“We will work closely with communities to find the right investment opportunities,” said Preston, “that will create jobs to suit their workforce and local economic development efforts.”

By John Rech